March 11, 2019 – Market review and metrics for Forex, Oil, S&P500 & Yields.

Pivot points, Support, Resistance & Fibonacci Reversal levels; Chart of Interest – <Oil_WTI>. {updated 5PM EST }

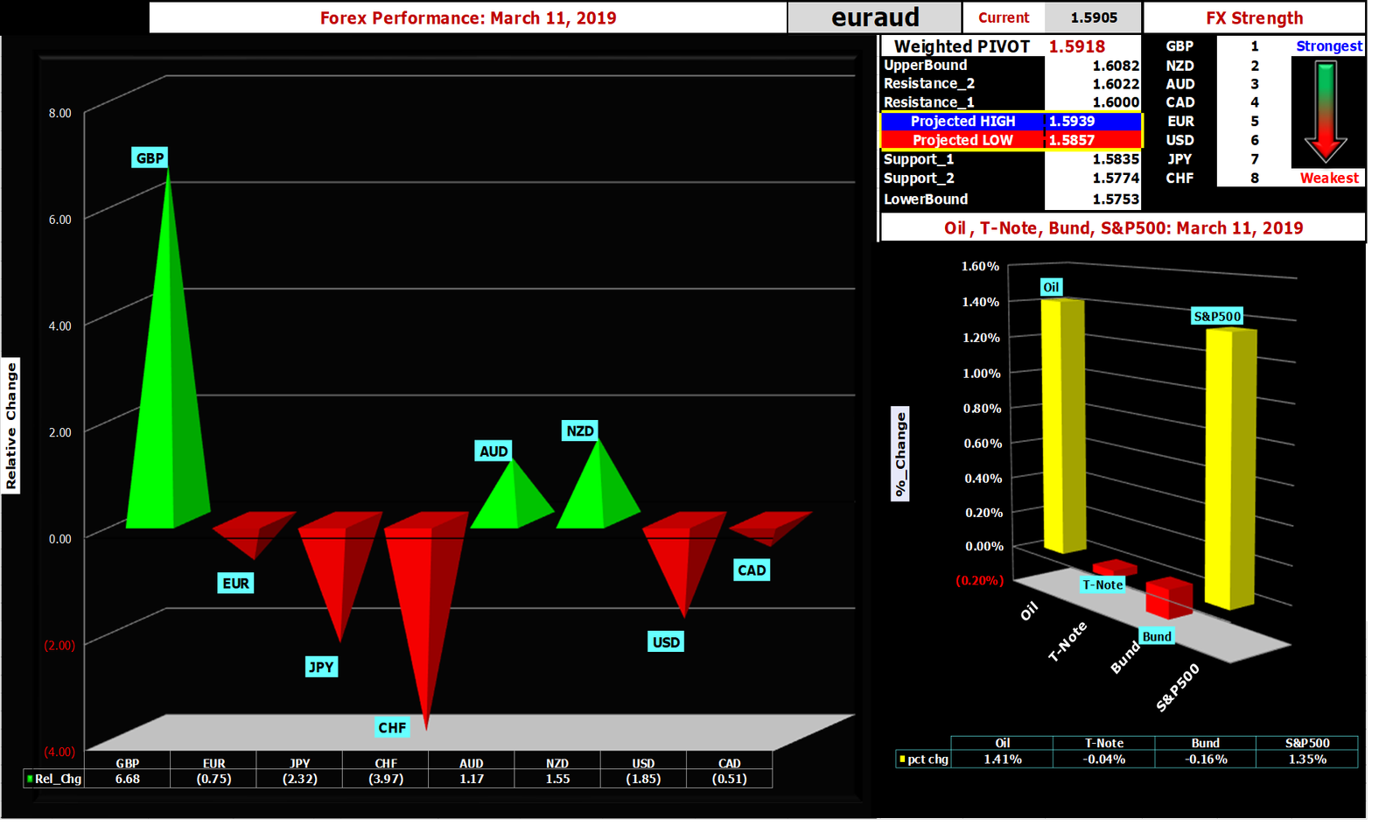

| FX Performance (Strongest to Weakest) |

| Strongest |

Weakest |

| GBP |

NZD |

AUD |

CAD |

EUR |

USD |

JPY |

CHF |

| Best Performer |

Worst Performer |

| GBPCHF |

EURGBP |

| Market |

Comments |

| Forex |

The British Pound outperformed the rest of the majors as a crucial week for BREXIT begins. The first vote is to either accept or reject PM May’s proposed deal to BREXIT and will be held on March 12, 2019 evening (BST) after a full day of debate. This had been roundly rejected when a previous vote was held and consensus is that this will be the outcome again. If this does pass this time then BREXIT will being on March 29, 2019 but in an orderly manner where the status quo would prevail while a permanent trading agreement is ironed out. The key is that the deadline would be December of 2020 and threats of chaos would be minimized. If it is rejected again as most experts expect then there will be a second referendum on March 13, 2019 where the Members of Parliament will vote on “NO DEAL BREXIT” which, as the name implies, means that UK will leave EU without a deal on March 29, 2019. This is the outcome that causes the most angst in financial markets. There have been calls of GBPUSD at 1.10 in short order if NO DEAL BREXIT happens. Rejecting this will bring about a third vote on March 14, 2019 where the topic is to request a DELAY to BREXIT. This appears to be the likely result, at least the one that the market prefers. |

| S&P500 |

S&P500 ended the day up and would have been higher had it not been for Boeing’s stock getting hammered. The fatal air crash over the weekend, the second involving a Boeing plane in the past few months, saw investors bailing on the world’s largest plane maker. |

Oil & Yields

|

Crude oil rose by 1.4% as the verbal tug of war between OPEC+ and market forces continues. Today OPEC+ won as remarks by a high ranking Saudi official doubling down on production cuts buoyed the commodity.

US and German 10Yr yields were marginally higher. |