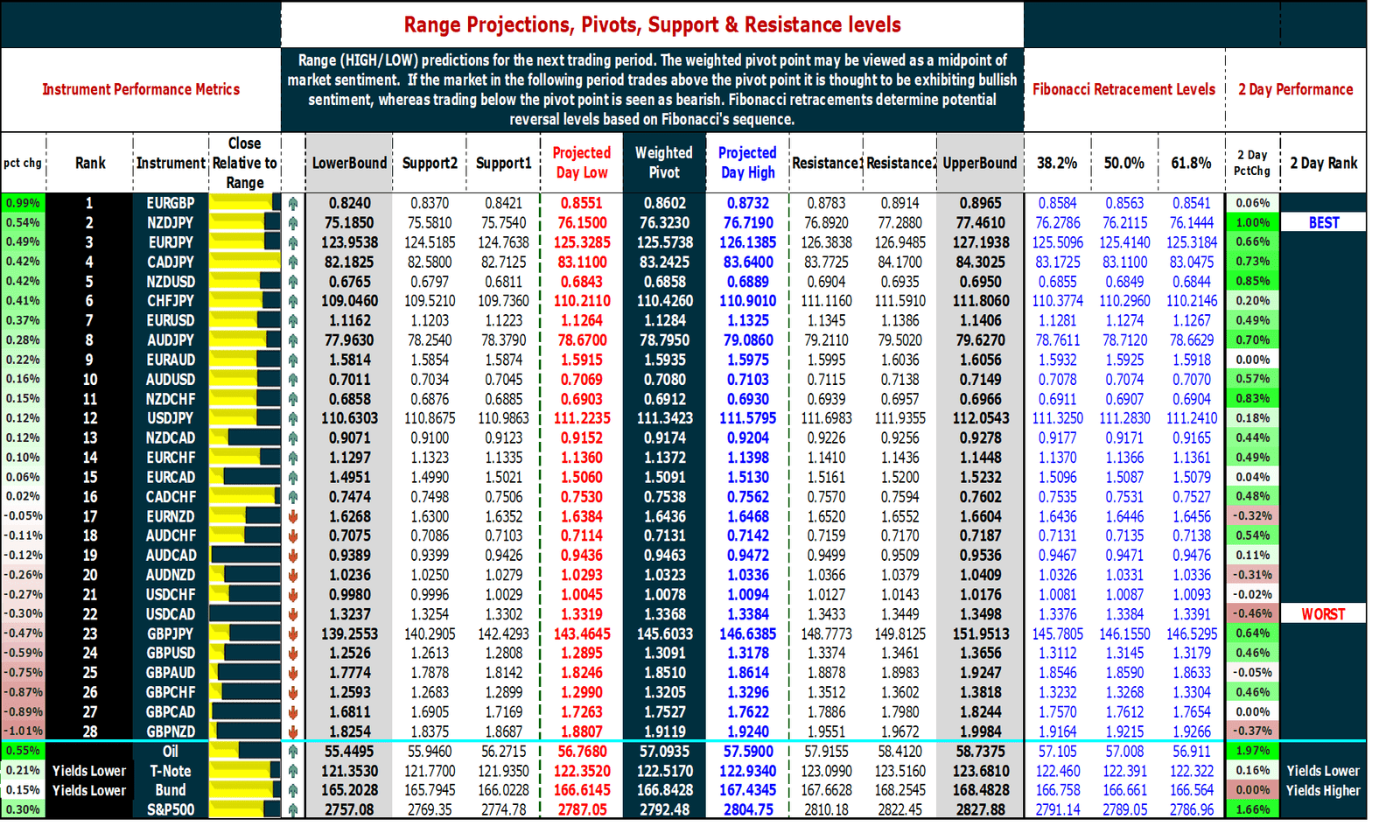

March 12, 2019 – Market review and metrics for Forex, Oil, S&P500 & Yields.

Pivot points, Support, Resistance & Fibonacci Reversal levels; Chart of Interest – <NZDUSD>. {updated 5PM EST}

| FX Performance (Strongest to Weakest) |

| Strongest |

Weakest |

| NZD |

EUR |

CAD |

CHF |

AUD |

USD |

JPY |

GBP |

| Best Performer |

Worst Performer |

| EURGBP |

GBPNZD |

| Market |

Comments |

| Forex |

New Zealand Dollar ended the day as the best performer while the Pound lagged the rest of the majors. The British unit experienced volatility as it gyrated within a 300 pip range. The reason was quite obvious as today was the day for the big vote to approve PM Mays’ negotiated deal to exit the European Union in as orderly manner as possible. This was thoroughly rejected again, though the margin was slightly smaller (391/242 -vs- 432/202 on January 15, 2019). Despite the PM’s last minute efforts, the issue of the “backstop”, a safety arrangement that bypasses the return to a hard border between Northern Ireland (part of UK) and Ireland (remains in EU) if an appropriate deal cannot be reached after BREXIT, remained contentious. Next comes the vote, slated for tomorrow, that will have financial markets on tenterhooks. Will UK leave the EU without a deal? – The “NO DEAL BREXIT”. Consensus is for this to be resoundingly rejected as well but that will do nothing to allay investor apprehension. |

| S&P500 |

Rally in technology stocks, a tepid report on inflation (core CPI was lower than market expectations) and further jaw-boning by a high ranking Trump administration official that US-China trade deal talks were getting close to completion all contributed to equities ending the day higher. |

Oil & Yields

|

Crude oil continued to climb abetted by OPEC+ policies to stabilize prices, worsening of the Venezuelan crisis and a weaker US Dollar.

US and German 10Yr yields were lower. |