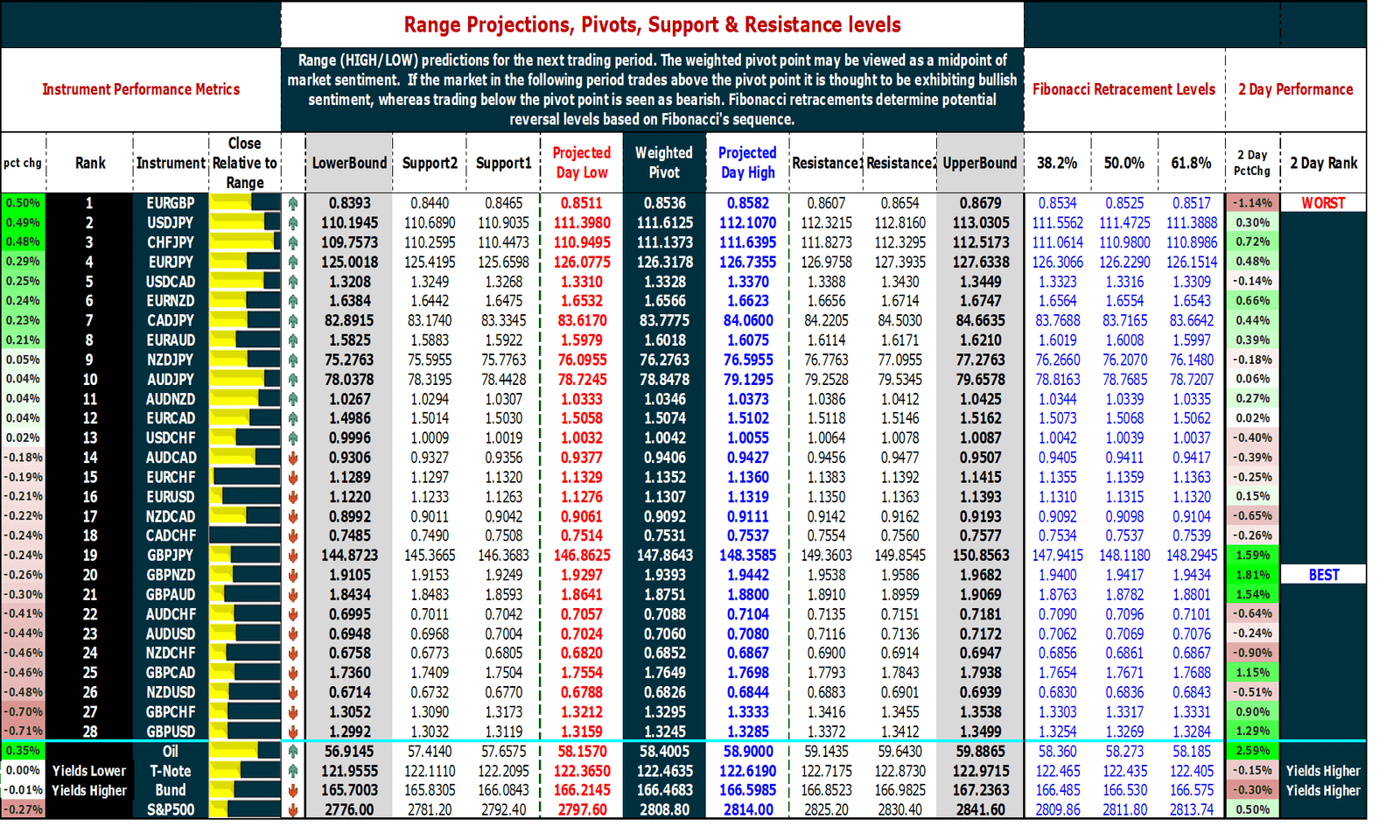

March 14, 2019 – Market review and metrics for Forex, Oil, S&P500 & Yields. Pivot points, Support, Resistance & Fibonacci Reversal levels and Chart of Interest – <GBPUSD>. {updated 5PM EST }

| FX Performance (Strongest to Weakest) |

| Strongest |

Weakest |

| USD |

CHF |

EUR |

CAD |

AUD |

NZD |

JPY |

GBP |

| Best Performer |

Worst Performer |

| EURGBP |

GBPUSD |

| Market |

Comments |

| Forex |

US Dollar was the best performer while the British Pound under performed the rest of its major brethren. Members of Parliament completed the sequence of votes and they went according to market expectations. Now its up to the EU to grant the request for delay and, if this is granted, then the focus returns to the MP’s to decide as to how they will BREXIT. |

| S&P500 |

S&P500 index ended the session marginally lower on uncertainty over the depth of progress in US – China trade deal negotiations. Also the 4 day rally propelled the market to upper end of the 2800-20 zone, a level that has earned the moniker of “strong resistance”, and investors might have pared exposure a bit as they await fresh stimuli. |

Oil & Yields

|

Crude oil was up but gains were muted as the spectre of global economic slowdown looms. |