Yield Curve Data (Source: FRED)

| Date | 3-mth | 2-yr | 5-yr | 10-yr | HY-OAS spread | Aaa | Baa |

|---|---|---|---|---|---|---|---|

| 2/20/2026 | 3.69 | 3.47 | 3.65 | 4.08 | 2.88 | 5.26 | 5.76 |

| 2/13/2026 | 3.68 | 3.40 | 3.61 | 4.04 | 2.95 | 5.25 | 5.76 |

| 2/6/2026 | 3.68 | 3.50 | 3.76 | 4.22 | 2.87 | 5.37 | 5.87 |

| 1/30/2026 | 3.67 | 3.52 | 3.79 | 4.26 | 2.80 | 5.38 | 5.88 |

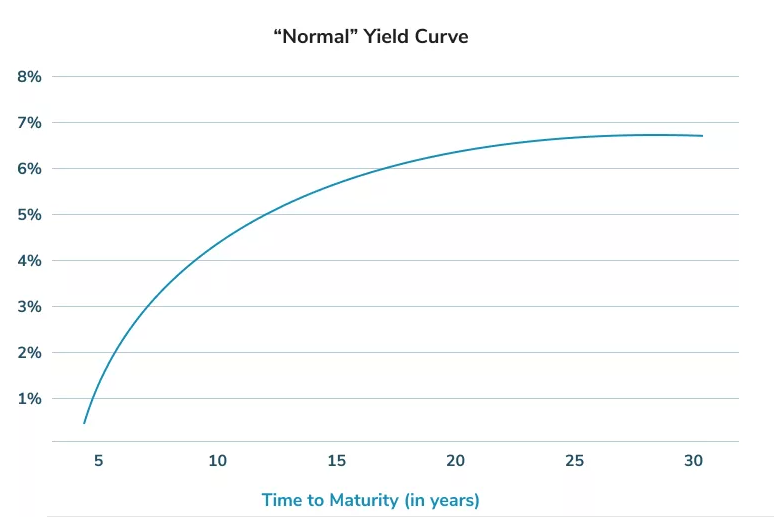

An upward-sloping (STEEPENING) long end that strengthens the case for a “re-acceleration” or “reflation” outlook.

- Significant Long-End Steepening

The spread between the 2-year (3.47%) and the 10-year (4.08%) is now 61 basis points.

- The Signal: Either a classic “bull steepener” IF the 2-year is falling faster than the 10-year, or a “bear steepener” if the 10-year is rising faster then the 2-year. It indicates that while the market expects the Fed to cut rates in the short term (3-month vs 2-year inversion), it expects higher nominal growth and inflation over the next decade.

- Term Premium: Investors are demanding a higher premium (4.08% vs 3.65% for the 5-year) to lock up their money for 10 years, suggesting they do not see a return to the “zero-rate” era anytime soon.

- The “U-Shaped” Yield Curve

With the 10-year at 4.08%, the curve is U-shaped.

- Front End (3m – 2y): Inverted (Recession hedge/Rate cut expectations).

- Back End (2y – 10y): Sharply positive (Growth/Inflation expectations).

- The Interpretation: The market is betting on a “Soft Landing” or “No Landing.” It suggests the Fed will successfully lower rates to a “neutral” level (but that appears to be around 3.5% in the market’s eye) without crashing the economy, allowing growth to pick back up in the long run.

- Corporate Credit vs. Risk-Free Benchmarks

The 10-year Treasury is the “risk-free” benchmark for long-term corporate debt.

- Aaa Spread: The Aaa yield (5.26%) is 118 bp above the 10-year Treasury. This is a very healthy, standard spread for top-tier credit, indicating no signs of stress in the plumbing of the financial system.

- The Hight Yield Option-Adjusted Spread (HY-OAS) is at 295 bp which means that investors are willing to accept a much lower premium to invest in “junk” bonds as the perceived risk of corporate defaults is low.

- Equity Valuation Pressure: A note of caution for equity investors – the 10-year yield crossing the 4.00% threshold often acts as a headwind for stock market valuations (specifically tech/growth stocks), as the “discount rate” for future earnings increases.

Summary

| Metric | Spread (bp) | Analysis |

|---|---|---|

| 10yr- 3mo | +45 | Overall, the curve is positive = recessions fears are fading |

| 10yr - 2yr | +68 | Fairly robust signal of economic "normalization" |

| Aaa - 10yr | +117 | healthy, standard spread for top-tier credit, indicating no signs of stress in the plumbing of the financial system. |

| HY-OAS | +295 | indicates a high level of market confidence and a low perceived risk of corporate defaults. This value is significantly lower than the long-term historical average of approximately 5.20%, signaling that investors are currently willing to accept a much smaller premium for holding "junk" bonds over risk-free U.S. Treasuries. |